2014–15 Departmental Performance Report

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

(Click to read the Financial Statements, Supplementary Information Tables and Annex.)

ISSN 2368-4542

PDF Version: 2014–15 Departmental Performance Report

Table of Contents

Section I: Organizational Expenditure Overview

- Organizational Profile

- Organizational Context

- Actual Expenditures

- Alignment of Spending With the Whole-of-Government Framework

- Departmental Spending Trend

- Expenditures by Vote

Section II: Analysis of Program by Strategic Outcome

- Strategic Outcome: Wrongdoing in the federal public sector is addressed and public servants are protected in case of reprisal

- Program 1.1: Disclosure and Reprisal Management Program

- Internal Services

Section III: Supplementary Information

- Financial Statements Highlights

- Financial Statements

- Supplementary Information Tables

- Tax Expenditures and Evaluations

Section IV: Organizational Contact Information

Commissioner's Message

Commissioner

I am honoured to have been appointed Public Sector Integrity Commissioner of Canada on March 27, 2015. This report will speak to our activities during the past fiscal year, most of which was under the direction of my predecessor, Mario Dion. We wish him well in his new endeavours and thank him for his four years of service to our organization.

As a matter of highest priority in my new position, I want to underscore my commitment to carrying out the important mandate given to our Office by Parliament to provide a safe, confidential and trustworthy means of disclosing wrongdoing in the public sector and to provide recourse to public servants who have been victims of reprisal as a result of a disclosure.

We have solid experience to build upon, but we also have much work ahead of us. Under the guiding principles of clarity, consistency and accessibility, I want to provide to public servants and to all Canadians, the support they need to make confident and informed decisions about coming forward to our Office. Our goal is to strengthen the trust in our public institutions and in public servants, by building a robust, fair and independent whistleblowing regime. With a strong team of dedicated professionals working together to achieve this goal, I am confident of our ability to continue to effectively deliver our sensitive and important mandate.

Joe Friday

Public Sector Integrity Commissioner

Section I: Organizational Expenditure Overview

Organizational Profile

Appropriate Minister: The Honourable Scott Brison, President of the Treasury Board

Institutional Head: Joe Friday, Public Sector Integrity Commissioner

Ministerial Portfolio: Treasury Board Secretariat

Enabling Instrument: Public Servants Disclosure Protection Act, S.C. 2005, c. 46

Year of Incorporation / Commencement: 2007

Other: The Office of the Public Sector Integrity Commissioner of Canada supports the Public Sector Integrity Commissioner, who is an independent Agent of Parliament.

Organizational Context

Raison d'être

The Office of the Public Sector Integrity Commissioner of Canada (the Office) was set up to administer the Public Servants Disclosure Protection Act (the Act), which came into force in April 2007. The Office is mandated to establish a safe, independent, and confidential process for public servants and members of the public to disclose potential wrongdoing in the federal public sector. The Office also helps to protect public servants who have filed disclosures or participated in related investigations from reprisal.

The disclosure regime is an element of the framework which strengthens accountability and management oversight in government operations.

Responsibilities

The Office has jurisdiction over the entire federal public sector, including separate agencies and parent Crown corporations, which represents approximately 375,000 public servants. Under the Act, members of the general public can also come to the Office with information about a possible wrongdoing in the federal public sector. However, the Office does not have jurisdiction over the Canadian Forces, the Canadian Security Intelligence Service, and the Communications Security Establishment, each of which is required under the Act to establish internal procedures for disclosure of wrongdoing and protection against reprisal similar to those set out in the Act.

The Office conducts independent reviews and investigations of disclosures of wrongdoing and complaints of reprisal in a fair and timely manner. In cases of founded wrongdoing, the Commissioner issues findings, through the tabling of a case report to Parliament, and makes recommendations to chief executives for corrective action. The Commissioner exercises exclusive jurisdiction over the review, investigation and conciliation of reprisal complaints. This includes making applications to the Public Servants Disclosure Protection Tribunal, which has the power to determine if reprisals have taken place and to order appropriate remedial and disciplinary action.

The Office is guided at all times by the public interest and the principles of natural justice and procedural fairness. The Commissioner submits an annual report to Parliament and special reports may also be submitted to Parliament at any time.

More information about the Office's mandate, roles, responsibilities, activities, statutory reports and the Act can be found on the Office's website.

Strategic Outcome and Program Alignment Architecture

1. Strategic Outcome: Wrongdoing in the federal public sector is addressed and public servants are protected in case of reprisal

1.1 Program: Disclosure and Reprisal Management Program

Internal Services

Organizational Priorities

| Priority | Type | Program |

|---|---|---|

| Disclosure and reprisal management function that is timely, rigorous, independent and accessible | Ongoing | Disclosure and Reprisal Management Program |

| Summary of Progress | ||

What progress has been made toward this priority? The Office made significant progress against the plans identified in its 2014–15 Report on Plans and Priorities to support this priority. The Office, in regard to standardizing, documenting and implementing operational processes, for example:

The quality assurance process planned activities were delayed to 2015-16 to allow for resources to formalize the approach and update the program to reflect updates to internal processes. Further in the area of security, privacy, and confidentiality standards, the Office addressed recommendations from the 2013-14 internal audit on information management and privacy in relation to the operations. This included participation by all staff in completing the security awareness on line course offered by the Canada School of Public Service, introducing updated technology for recording devices, and reviewing and documenting processes related to receipt of information. The Office carried out a comprehensive update to the organization's risk assessment in October and this assessment was the basis for the strategic plan, operational plans and the internal audit and evaluation plans developed and approved in 2015. | ||

| Priority | Type | Program |

|---|---|---|

| Engagement of key stakeholders | Ongoing | Disclosure and Reprisal Management Program |

| Summary of Progress | ||

What progress has been made toward this priority? In 2014-15, as in previous years the Office proactively engaged with public servants by presenting at various events across the public service including conferences, staff and executive staff meetings of federal departments and crown corporations, the cross government interdepartmental network on values and ethics and a webcast hosted by the Federal Youth Network and the Canada School of Public Service. In 2014, to modernize communication tools, the Office created a video, a GCpedia page and re-launched the corporate twitter account to engage and inform public sector employees. Public sector unions are a key stakeholder within the whistleblowing regime and, as such, are represented on the external Advisory Committee. In 2014, the Association of Canadian Financial Officers joined the Advisory Committee and spearheaded a joint project to collaborate with the union's labour relations advisors and to identify information and awareness tools that could assist public sector employees. The Office updated its documentation of recommendations for legislative changes, including perspectives and experiences administering the Act, in preparation for an independent review of the Act. | ||

| Priority | Type | Program |

|---|---|---|

| Human resource capacity that meets organizational needs | Ongoing | Disclosure and Reprisal Management Program Internal Services |

| Summary of Progress | ||

What progress has been made toward this priority? In 2014-15, the Office established staffing pools for case analysts and investigators. In 2015-16, the qualified candidates in the pools are being hired to address the resourcing needs that emerged. The Office continues to actively support staff development, approving secondment assignments, new responsibilities and project opportunities in house, and training as required to engage and retain staff. The staff were invited to participate in the risk assessment process and subsequent development of the three year strategic plan in 2014-15. | ||

Risk Analysis

Key Risks

| Risk | Risk Response Strategy | Link to Program Alignment Architecture |

|---|---|---|

| Case Volumes: The Office's ability to respond in a timely manner can be impacted by increasing case volumes or if the mix of complexity in the case workload increases. | This risk was identified in the 2014-15 RPP. Reporting on compliance with service standards and trends ensures that management is informed and that actions are taken as appropriate. | Disclosure and Reprisal Management Program |

| Information Security: This is critical in the context of disclosures, investigations and the need for preserving confidentiality and trust in the Office. Sensitive or private information must be protected from potential loss or inappropriate access in order to avoid potential litigation, damaged reputation and further reluctance in coming forward. | This risk was identified in the 2014-15 RPP. The Office has ongoing practices aimed at ensuring the security of information, which include security briefings and confidentiality agreements, random information security checks within premises, and controlled access for the storage of sensitive information. | Disclosure and Reprisal Management Program |

Risks can arise from events that the Office cannot influence or by factors outside our control, but the Office must be able to monitor and respond accordingly in order to mitigate the impact, in order to address disclosures of wrongdoing and complaints of reprisal. All of the organizational priorities contribute either directly or indirectly to mitigating the risk of increasing case volumes and/or complexity that may in turn impact the timeliness of completing case files. In particular, a disclosure and reprisal management function that is timely, rigorous, independent and accessible supports effective and efficient use of resources and case file decisions which are clear and complete, minimizing the need for further allocations of resources. The Audit and Evaluation Committee provides advice to the Commissioner on risk and annually reviews the Office's risk profile.

Actual Expenditures

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates | 2014–15 Planned Spending | 2014–15 Total Authorities Available for Use | 2014–15 Actual Spending (authorities used) | Difference (actual minus planned) |

|---|---|---|---|---|

| 5,426,234 | 5,746,234 | 5,658,036 | 4,841,027 | (905,207) |

Human Resources (Full-Time Equivalents FTEs)

| 2014–15 Planned | 2014–15 Actual | 2014–15 Difference (actual minus planned) |

|---|---|---|

| 31 | 26 | (5) |

Budgetary Performance Summary for Strategic Outcome and Program (dollars)

| Strategic Outcome(s), Program(s) and Internal Services | 2014–15 Main Estimates | 2014–15 Planned Spending | 2015–16 Planned Spending | 2016–17 Planned Spending | 2014–15 Total Authorities Available for Use | 2014–15 Actual Spending (authorities used) | 2013–14 Actual Spending (authorities used) | 2012–13 Actual Spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Strategic Outcome: 1. Wrongdoing in the federal public sector is addressed and public servants are protected in case of reprisal | ||||||||

| 1.1 Disclosure and Reprisal Management Program | 3,571,794 | 3,891,794 | 3,418,985 | 3,418,985 | 3,121,395 | 2,692,847 | 3,608,322 | 3,627,994 |

| Subtotal | 3,571,794 | 3,891,794 | 3,418,985 | 3,418,985 | 3,121,395 | 2,692,847 | 3,608,322 | 3,627,994 |

| Internal Services Subtotal | 1,854,440 | 1,854,440 | 2,029,457 | 2,029,457 | 2,536,641 | 2,148,180 | 1,934,719 | 1,915,002 |

| Total | 5,426,234 | 5,746,234 | 5,448,442 | 5,448,442 | 5,658,036 | 4,841,027 | 5,543,041 | 5,542,996 |

The Office's total authorities of $5.7 million reflect an increase of $0.3 million (6%) over the budgetary expenditures of $5.4 million, which represents the 5% operating budget carry forward from 2013-14. This incremental authority was considered in establishing the planned spending of $5.7 million. The Office's total 2014-15 spending of $4.8 million is $0.9 million (16%) lower than its planned spending of $5.7 million. Personnel costs of the Office in 2014-15 accounted for 70% of spending and professional fees accounted for 20% of spending. The overall lower level of authorities used in comparison to the planned spending was a result of unplanned vacancies, delayed staffing, and a reduced use of external resources for investigations, offset in part by a one-time transition payment for implementing salary payment in arrears by the Government of Canada in 2014-15.

Alignment of Spending With the Whole-of-Government Framework

Alignment of 2014-15 Actual Spending With the Whole-of-Government Framework (dollars)

| Strategic Outcome | Program | Spending Area | Government of Canada Outcome | Actual Spending |

|---|---|---|---|---|

| 1. Wrongdoing in the federal public sector is addressed and public servants are protected in case of reprisal | 1.1 Disclosure and Reprisal Management Program | Government Affairs | A transparent, accountable and responsive federal government | 2,692,847 |

Total Spending by Spending Area (dollars)

| Spending Area | Total Planned Spending | Total Actual Spending |

|---|---|---|

| Government affairs | 3,891,794 | 2,692,847 |

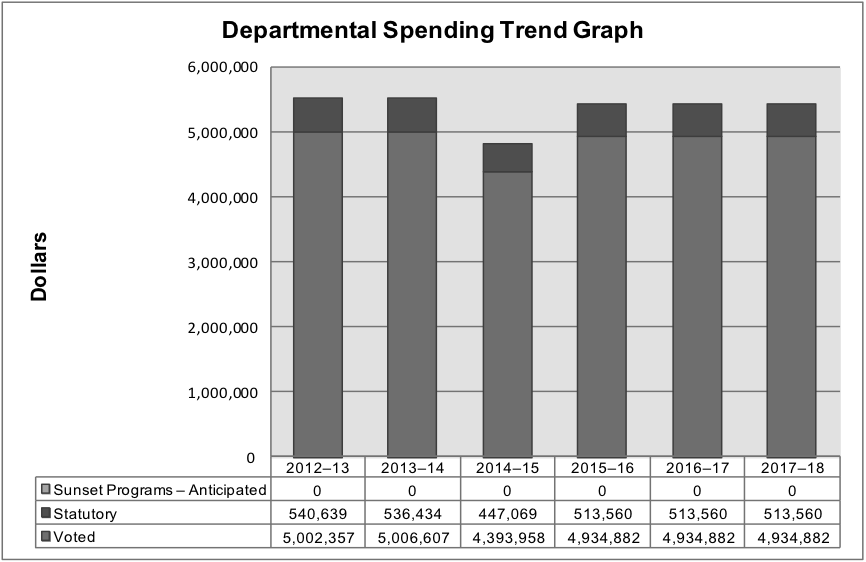

Departmental Spending Trend

Text Version

This bar graph illustrates the spending trend for the Office’s program expenditures (Vote 1) related to actual spending for fiscal years 2012–13, 2013-14 and 2014–15, and planned spending for fiscal years 2015–16, 2016–17 and 2017–18. Financial figures are presented in dollars along the y axis, increasing by $1 million increments to $6 million. These are graphed against fiscal years 2012–13 to 2017–18 on the x axis.

There are two items identified for each fiscal year, the first one being statutory items, comprised of contributions to employee benefit plans, and the other, the Office's program expenditures (Vote 1).

In 2012–13, actual spending was $540,639 for statutory items and $5,002,357 for program expenditures.

In 2013–14, actual spending was $536,434 for statutory items and $5,006,607 for program expenditures.

In 2014–15, actual spending was $447,069 for statutory items and $4,393,958 for program expenditures.

Planned spending for statutory items will remain the same for fiscal years 2015–16 to 2017–18 in the amount of $513,560.

Planned spending for program expenditures will remain the same for fiscal years 2015–16 to 2017–18 in the amount of $4,934,882.

The Office's spending had stabilized and then dropped in 2014-15 as a number of vacant staff positions increased and professional services for operational activities declined. The 2015-16 through 2017-18 higher planned spending reflects the staffing of vacant positions.

Expenditures by Vote

For information on the Office of the Public Sector Integrity Commissioner's organizational voted and statutory expenditures, consult the Public Accounts of Canada 2015, which is available on the Public Works and Government Services Canada website.

Section II: Analysis of Program by Strategic Outcome

Strategic Outcome: Wrongdoing in the federal sector is addressed and public servants are protected in case of reprisal.

Program 1.1: Disclosure and Reprisal Management Program

Description

The objective of the program is to address disclosures of wrongdoing and complaints of reprisal and contribute to increasing confidence in federal public institutions. It aims to provide advice to federal public sector employees and members of the public who are considering making a disclosure and to accept, investigate and report on disclosures of information concerning possible wrongdoing. Based on this activity, the Public Sector Integrity Commissioner will exercise exclusive jurisdiction over the review, conciliation and settlement of complaints of reprisal, including making applications to the Public Servants Disclosure Protection Tribunal to determine if reprisals have taken place and to order appropriate remedial and disciplinary action.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates | 2014–15 Planned Spending | 2014–15 Total Authorities Available for Use | 2014–15 Actual Spending (authorities used) | 2014–15 Difference (actual minus planned) |

|---|---|---|---|---|

| 3,571,794 | 3,891,794 | 3,121,395 | 2,692,847 | (1,198,947) |

Human Resources (Full-Time Equivalents FTEs)

| 2014–15 Planned | 2014–15 Actual | 2014–15 Difference (actual minus planned) |

|---|---|---|

| 23 | 18 | (5) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| The disclosure and reprisal management function is efficient. | Compliance with published service standards. | 80% | 84% to 100% |

| The disclosure and reprisal cases are addressed with decisions that are clear and complete. | Requests for reconsideration in comparison to cases received over three years. | No more than 10% | 1% |

| Successful applications for judicial review in comparison to the total number of cases received over three years. | No more than 2% | 0.3% |

Performance Analysis and Lessons Learned

The Office tabled two case reports of wrongdoing in Parliament and made three applications regarding reprisal complaints to the Tribunal. The case reports, along with other operational achievements are summarized in the Annual Report on the Office's website. The Office received 194 general inquiries, 90 new disclosures of wrongdoing and 28 new complaints of reprisal. The progress on action plans was highlighted in Section I under Organizational Priorities.

The legislation requires a case analysis of complaints of reprisal be completed in 15 days and, on this standard, the Office achieved a 100% level of compliance. In 2014, the Office published and reported on its self-determined service standards, which include:

- General inquiries will be responded to within 1 working day, which was achieved for 99% of the enquiries.

- Conducting case analysis for disclosures of wrongdoing within 90 days of opening a file which determines if an investigation will be launched. This service standard was achieved on 84% of the files.

- Investigations will be completed within one year of being launched. This service standard was achieved on 86% of the files.

In 2015, there was one successful judicial review ruled by the Federal Court of Appeal which supported the request of a complainant. This decision provided enhanced guidance for meeting the obligations under the Act, resulting in clarifying the threshold for launching an investigation for a complaint of reprisal. It is also noteworthy that the decision of whether to investigate had been subject to a judicial review in a disclosure of wrongdoing and, in that case, the Federal Court of Appeal upheld the basis of determination followed by the Office. These decisions assisted in clarifying the differing roles and discretion that the Commissioner has for a disclosure of wrongdoing and a complaint of reprisal.

Internal Services

Description

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are Management and Oversight Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not those provided to a specific program.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates | 2014–15 Planned Spending | 2014–15 Total Authorities Available for Use | 2014–15 Actual Spending (authorities used) | 2014–15 Difference (actual minus planned) |

|---|---|---|---|---|

| 1,854,440 | 1,854,440 | 2,536,641 | 2,148,180 | 293,740 |

Human Resources (Full-Time Equivalents FTEs)

| 2014–15 Planned | 2014–15 Actual | 2014–15 Difference (actual minus planned) |

|---|---|---|

| 8 | 8 | 0 |

Performance Analysis and Lessons Learned

The Office continued to access shared services from other government departments for the cost-effective delivery of human resources, finance, security, and information technology services.

An updated risk assessment was completed which was then used as an integral element in establishing an Audit and Evaluation Plan, Strategic Plan, and operational plans. As a result, no internal audits were conducted last year as it was determined prudent to await the revised plan and its approval.

During the year the Office implemented a document management system, RDIMS, to support business processes and to assist in managing digital information, including discovery, preservation, and disposition of records. This system has not been fully adopted and the Office is implementing steps to expand its application. In addition, the Office continued to participate in the cross government shared case management system initiative.

The Office's website was accessed by 21,024 unique visitors in 2014-15, with peak visits occurring at the time a case report was tabled in Parliament. A short and informative video was produced and added to the website and distributed, via a link, to all Deputy Heads in 2014-15 by the Commissioner.

Section III: Supplementary Information

Financial Statements Highlights

The highlights presented in this section are drawn from the Office's financial statements and are prepared on an accrual basis. These financial statements have been prepared using Government of Canada accounting policies, which are based on Canadian public sector accounting standards. The Office has received an unmodified audit opinion of its Financial Statements from the Office of the Auditor General of Canada, which has been the auditor since 2008.

Condensed Statement of Operations For the Year Ended March 31, 2015 (dollars)

| Financial Information | 2014–15 Planned Results | 2014–15 Actual | 2013–14 Actual | Difference (2014–15 actual minus 2014–15 planned) | Difference (2014–15 actual minus 2013–14 actual) |

|---|---|---|---|---|---|

| Total expenses | 6,386,704 | 5,398,175 | 6,179,353 | -988,529 | -781,178 |

| Total revenues | 0 | 0 | 0 | ||

| Net cost of operations before government funding and transfers | 6,386,704 | 5,398,175 | 6,179,353 | -988,529 | -781,178 |

The actual total expenses of $5.4 million reflect a decrease of $0.8 million as compared with 2013-14 and, is in part, $0.5 million, due to a reduction in personnel costs corresponding to an overall lower level of FTE, reflecting vacant positions that resulted from staff turnover. The balance of decreased expenses reflects costs in 2013-14 contributed to the government wide case management system, carpeting and computers that were not incurred in 2014-15. The actual total expenses were lower than planned by $1.0 million as a result of the vacant positions and a reduced requirement for external operational resources.

Condensed Statement of Financial Position As at March 31, 2015 (dollars)

| Financial Information | 2014–15 | 2013-2014 | Difference (2014–15 minus 2013–14) |

|---|---|---|---|

| Total net liabilities | 840,147 | 837,254 | 2,893 |

| Total net financial assets | 466,014 | 423,804 | 42,210 |

| Departmental net debt | 374,133 | 413,450 | -39,317 |

| Total non-financial assets | 171,658 | 216,931 | -45,273 |

| Departmental net financial position | -202,475 | -196,519 | -5,956 |

The total liabilities, as at the end of the year, were $0.8 million, made up of accounts payable, accrued salaries, employee future severance benefits and vacation pay liabilities. The total financial assets as at the end of the year were $0.4 million and reflect amounts due from the Consolidated Revenue Fund and amounts in accounts receivable (primarily from other government departments). Departmental net debt of $0.4 million, calculated as the difference between total net liabilities less net financial assets, has decreased slightly compared to the previous year, which is mainly explained by an increase in accounts receivable from other government departments. The net debt indicator represents future funding requirements to pay for past transactions and events, and is one indicator of a department's financial position. The total non-financial assets reflect the net book value of capital assets as at March 31 and have decreased as the assets are being amortized over their expected useful life and minimal new investments in capital were made in 2014-15.

Financial Statements

The Office of the Public Sector Integrity Commissioner Audited Financial Statements for the Year Ended March 31, 2015, which include the Statement of Management Responsibility Including Internal Control over Financial Reporting and its Annex for fiscal year 2014–15, can be found on the Office's website.

Supplementary Information Tables

The supplementary information tables listed in the 2014–15 Departmental Performance Report are available on the Office of the Public Sector Integrity Commissioner's website.

- Departmental Sustainable Development Strategy;

- User Fees, Regulatory Charges and External Fees.

Tax Expenditures and Evaluations Report

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures annually in the Tax Expenditures and Evaluations publication. The tax measures presented in the Tax Expenditures and Evaluations publication are the responsibility of the Minister of Finance.

Organizational Contact Information

60 Queen Street, 7th Floor

Ottawa, Ontario K1P 5Y7

Canada

Telephone: 613-941-6400

Toll Free: 1-866-941-6400

Appendix: Definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Includes operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Departmental Performance Report (rapport ministériel sur le rendement)

Reports on an appropriated organization's actual accomplishments against the plans, priorities and expected results set out in the corresponding Report on Plans and Priorities. These reports are tabled in Parliament in the fall.

full-time equivalent (équivalent temps plein)

Is a measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

Government of Canada outcomes (résultats du gouvernement du Canada)

A set of 16 high‑level objectives defined for the government as a whole, grouped in four spending areas: economic affairs, social affairs, international affairs and government affairs.

Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats)

A comprehensive framework that consists of an organization's inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

non-budgetary expenditures (dépenses non budgétaires)

Includes net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues)

For Reports on Plans and Priorities (RPPs) and Departmental Performance Reports (DPRs), planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates. A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their RPPs and DPRs.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

priorities (priorité)

Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

program (programme)

A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

Program Alignment Architecture (architecture d'alignement des programmes)

A structured inventory of an organization's programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

Report on Plans and Priorities (rapport sur les plans et les priorités)

Provides information on the plans and expected performance of appropriated organizations over a three-year period. These reports are tabled in Parliament each spring.

result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization's influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique)

A long-term and enduring benefit to Canadians that is linked to the organization's mandate, vision and core functions.

sunset program (programme temporisé)

A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

whole-of-government framework (cadre pangouvernemental)

Maps the financial contributions of federal organizations receiving appropriations by aligning their Programs to a set of 16 government-wide, high-level outcome areas, grouped under four spending areas.